By Keabetswe Tsuene – Specialist Analyst: Retirement Fund Conduct Supervision (FSCA)

The FSCA has started publishing the names of employers that contravene section 13A of the Pension Funds Act 1956 (PFA). The first list of names was published on the FSCA website on 1 September 2023, titled FSCA Communication 21 of 2023 (RF) - Publication of names of retirement funds and employers with arrear contributions.

To contextualise, a contravention is where employers do not pay over employees’ contributions to their pension or provident funds by the 7th day of the month following the one in which contributions were due; or pay over contributions, but only after the 7th; and where employers fail to pay the resulting late payment interest.

The first publication covered 20 funds and named 3 262 employers that had contravened the Act across various sectors and industries. It is worth noting that the employers participating in the Private Security Sector Provident Fund accounted for 77% of the published list. This is of great concern to the FSCA. As a result, a task team has been created to assist the fund and administrator to deal with section 13A contraventions more effectively.

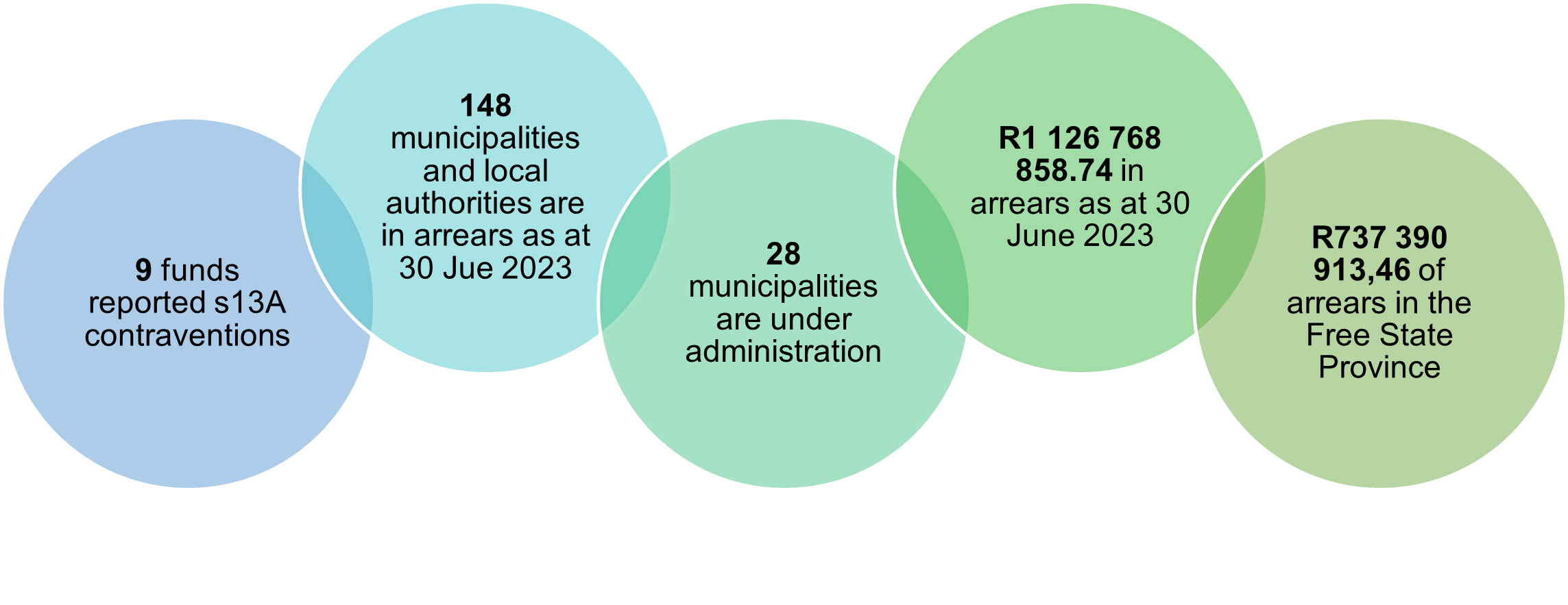

Following from the first publication, the FSCA embarked on an in-depth assessment of arrear contributions as at 30 June 2023, in funds that operate in the municipal and local authorities sector. We received responses from 15 funds, with six reporting that there were no contraventions to report. A summary is provided below:

Arrear contributions have been a long-standing issue in the retirement fund sector and challenges faced by retirement funds in respect of the recovery of outstanding contributions have been well documented and ventilated on various platforms. The issue has been exacerbated by the economic difficulties faced by our country.

Although it remains the responsibility of the board of a fund to institute legal action to recover outstanding contributions, a combined effort will be required to address the problem. In addition, a pragmatic approach will need to be adopted to deal with employers that are not able to meet their contractual obligations with employees. The same applies to municipalities, where the growing arrear contributions can potentially create a contingent liability for the State.

A project plan has been approved by the FSCA to deal with section 13A matters and the interaction with the relevant stakeholders to find solutions to mitigate this risk.

The FSCA anticipates publishing the next list of defaulting employers in the beginning of 2024. We will also publish the names of employers that were previously published erroneously and of those that have in the meantime made payment arrangements with the respective retirement funds.

|